COVID-19 Economic Recovery Resources

Florida Small Business Emergency Bridge Loan

The purpose of the program is to provide an expedient source of capital to impacted small businesses. The 1-year bridge loan is a short-term, interest-free source of working capital intended to help the business “bridge the gap” between the time of COVID-19 impacts and when federal assistance becomes available. Up to $50,000 is available per applicant.

Small business eligibility criteria:

-

Business employees between 2 and 100 employees

-

Business established prior to March 9, 2020

-

Business suffered economic injury as a result of COVID-19 crisis

Application deadline: May 8, 2020

The Apalachee Regional Planning Council is staying informed on the availability of grants, loans, and other resources to mitigate and recover from economic impacts

of COVID-19. As local, state, and federal resources become available, our team is ready to assist your business, organization, or local government with applications and other planning activities.

SBA Economic Injury Disaster Loan

The U.S. Small Business Administration (SBA) is offering low-interest federal disaster loans for working capital to small businesses suffering substantial economic injury as a result of COVID-19.

Businesses eligible for an Economic Injury Disaster Loan include private and non-profit organizations. The interest rate is 3.75% for small businesses and 2.75% for non-profits. Up to $2 million in assistance is available per applicant. Loans may be used to pay fixed debts, payroll, accounts payable, and other bills that cannot be paid due to COVID-19 impacts. As a note, small businesses eligible for the Small Business Emergency Bridge Loan should apply to that program before applying for an SBA loan.

ARPC is ready to help you prepare and recover.

As during any disaster, we are here to help our communities prepare and recover. Upon the activation of federal, state, and local disaster assistance, our team can assist you with preparing and submitting applications and with other ongoing or post-disaster challenges.

Contact Caroline Smith at csmith@arpc.org to learn more or request assistance.

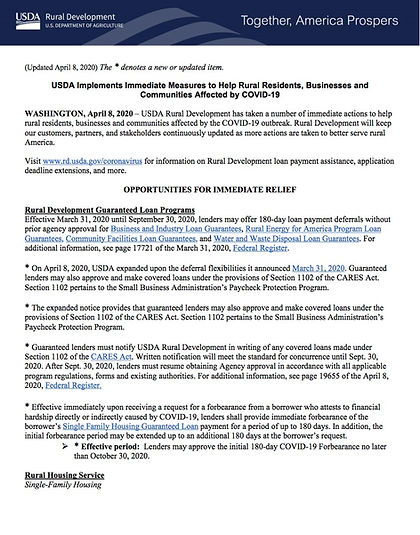

COVID-19 Federal Rural Resource Guide

USDA Implements Immediate Measures to Help Rural Residents, Businesses & Communities Affected

by COVID-19

The CEDR Grant Program dedicates $1 million locally to leverage and aligns with up to $800 million federal dollars to assist local small businesses. It offers an initial lifeline to local businesses to keep employees employed, thereby supporting continuity of operations as they weather the economic hardships during the first critical days and weeks of the COVID-19 pandemic.

The Tallahassee-Leon County Office of Economic Vitality (OEV) will administer the grant program to provide initial cash flow to businesses economically impacted by COVID-19. Up to $1 million has been allocated for the program and funds will be released on a rolling basis, beginning as soon as three to five days from now.

The distribution of the grant funds will be based on the number of employees. Once applied, businesses with one to 10 employees will be awarded $1,500, businesses with 11 to 24 employees will be awarded $2,500, and businesses with 25 to 50 employees will be granted $5,000.

For full information, please click here.

PLEASE NOTE: The OEV grant is only available for businesses that have

already applied to either the FL Small Business Emergency Bridge Loan or

SBA Economic Injury Disaster Loan. To be eligible for the OEV grant, please follow the steps below.

-

Apply for FL Small Business Emergency Bridge Loan (up

to $50,000) -

Apply for OEV grant (up to $5,000) while waiting for Bridge Loan

-

Apply for SBA Loan

The Paycheck Protection Program is a loan designed to provide a direct incentive for small businesses to keep their workers on the payroll. SBA will forgive loans if all employees are kept on the payroll for eight weeks and the money is used for payroll, rent, mortgage interest, or utilities. The Paycheck Protection Program will be available through June 30, 2020.

WHO CAN APPLY?

This program is for any small business with less than 500 employees (including sole proprietorships, independent contractors and self-employed persons), private non-profit organization or 501(c)(19) veterans organizations affected by coronavirus/COVID-19.

Businesses in certain industries may have more than 500 employees if they meet the SBA’s size standards for those industries. Small businesses in the hospitality and food industry with more than one location could also be eligible at the store and location level if the store employs less than 500 workers.This means each store location could be eligible.

COVID-19 PPP Lender Information Sheet

North Florida District Office (NFDO) Participating Lender List by County

CareerSource Capital Region COVID-19 Employer Toolkit

COVID-19 CARES Act Information

For a full overview of the 2019 CARES Act, please click here, or on the image to the right.

This toolkit is designed to assist Gadsden, Leon, and Wakulla County businesses and organizations in accessing critical workforce development resources, programs, and services that are needed during this time.

The toolkit provides a snapshot of resources and is meant to provide a foundation for stakeholders to identify initial information. Information may also be found on our Website.

Emergency Business Loans

The Small Business disaster loans are available to businesses, regardless of size, and nonprofits including charitable organizations such as churches and private universities. They are able to borrow up to $2 million.

Economic Injury Disaster Loan Program

The Florida Small Business Emergency Bridge Loan Program is currently available to small business owners located in all Florida counties statewide that experienced economic damage as a result of COVID-19.

Florida Small Business Emergency Bridge Loan Program

COVID-19 Emergency Disaster Relief Grant Program

The CEDR Grant Program dedicates $1 million locally to leverage and aligns with up to $800 million federal dollars to assist local small businesses. It offers an initial lifeline to local businesses to keep employees employed, thereby supporting continuity of operations as they weather the economic hardships during the critical first days and weeks of the COVID-19 pandemic.

The Tallahassee-Leon County Office of Economic Vitality (OEV) will administer the grant program to provide initial cash flow to businesses economically impacted by COVID-19.

The CEDR grant application closes Friday, April 24, 2020. To apply for the CEDR Grant Program, visit www.oevforbusiness.org/cedr-grant. For questions regarding the CEDR Grant Program, contact the OEV at info@OEVforBusiness.org.

“Families First” Coronavirus Relief Act Employment Law Update

Congress recently passed this law that goes into effect April 1, 2020. It requires employers with less than 500 employees to provide notice to employees and offer paid sick leave and FMLA for certain leave that employees may need to take due to the COVID-19 coronavirus. Download the required poster and learn more information about the requirements at:

https://www.dol.gov/agencies/whd/pandemic

How to Post Jobs

If you need to post positions or help finding candidates, please submit a position description to our Business Solutions team for assistance at cbes@careersourcecapitalregion.com. If you currently have an account on www.employflorida.com, you can also post the positions yourself at any time.

Short-Time Compensation

The Florida Department of Economic Opportunity administers a short-time compensation program for business that may need to help maintain their staff as a result of reducing weekly work hours due to a temporary slowdown.

Temporary Layoff Program

The Florida Department of Economic Opportunity’s Temporary Layoff program is for employees that are temporarily laid off from work that may be eligible for Reemployment Assistance benefits. A temporary layoff occurs when the employee is separated from their job due to lack of work and the employee has a return-to-work date within eight weeks of the separation.

Worker Adjustment and Retraining Notification (WARN)

The Worker Adjustment and Retraining Notification (WARN) Act offers protection to workers, their families, and their communities by requiring employers to provide notice 60 days in advance of covered plant closings and covered mass layoffs.

In response to a WARN notice, CareerSource Capital Region deploys its Rapid Response team. Rapid response ensures immediate access to affected workers to help them quickly re-enter the workforce and plays an important role in providing customer-focused solutions to both dislocated workers and employers.

OEV Business Resource Guide

COVID-19 is a challenge for local businesses and the whole community, and the Office of Economic Vitality’s team is focused on the continued success of local businesses. This business resource guide was developed to assist local businesses through the pandemic.

Manufacturing Training Grant

This CareerSource Capital Region grant is available to manufacturing employers in, Gadsden, Leon and Wakulla counties. Training is for specific trade skills to assist employers with retaining their current workforce and increasing their competitiveness. Training can be customized to fit the needs of the employer.

Finally, the CSCR team stands ready to assist in meeting your needs during this time of uncertainty, please contact Trish Yahn directly. Phone: (850) 617- 4603 Email: cbes@careersourcecapitalregion.com